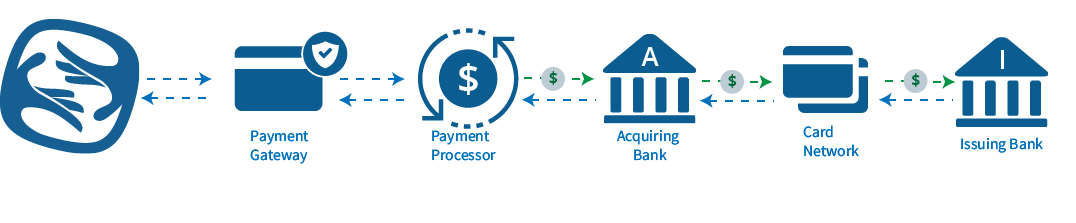

Online Payment Process

Click the icons in the online payment process diagram to learn more about each part of the online payment process, and how Sertifi makes collecting payments easy and secure. You connect your Sertifi Portal with one of the supported payment gateways to collect either credit card or ACH payments. For more information about setting up a gateway, see Payment Gateways.

Sertifi

The payment process starts with Sertifi. Through the Sertifi Portal, you send a contract with either a credit card or ACH form for your client to fill out. Your client fills out the form, including their payment information, and submits the documents back to Sertifi. The Sertifi system then takes your client’s payment information, tokenizes it, and sends the information to a payment gateway to start the online payment process. After that, your payment gateway and processor work together to transfer payment information and funds throughout the online payment process. Once this process is complete, you receive a completed contract and payment for your transaction.

Payment Gateway

A payment gateway is a service that authorizes and transmits payment information on behalf of the payment processor used by your acquiring bank.

Sertifi integrates with a variety of payment gateways including:

- Shift 4 Corporation

- CyberSource

- Authorize.Net

- 3C

- FreedomPay

- Converge (Elavon)

- Worldpay (Note: Sertifi uses the Express Direct Connect gateway, which is only available for use in the United States)

These payment gateway providers collect the tokenized payment information from Sertifi and sends the information to a payment processor. For more information, see Sertifi Payment Gateways.

Payment Processor

A payment processor transacts the payment, passing payment details for payment or authorization, between banks, and then transfers the actual payment between banks. The processor checks with an issuing bank to confirm if the payment information is valid, that the information matches, and if funds are available for purchase. You can leverage your existing account with your preferred payment processor like:

- First Data

- Chase Payment Tech

- Elavon

- TSYS

After the payment processor verifies that the payment information matches and funds are available, the processor places a hold for the funds, or immediately captures the funds for the payment. Then, the payment processor passes the information to your merchant services provider, who then places the funds into your merchant account.

For a full list of the payment processors Sertifi currently supports, view our Supported Gateway and Processor list.

Acquiring Bank

The acquiring bank is the bank that stores your money from a sale. This is where your merchant account is kept. After the transaction and payment information is collected, along with the funds, your payment gateway routes to your client's issuing bank via the card network.

Card Network

The card network informs the payment processor which issuing bank your client belongs to. After the routing to the issuing bank occurs via the card network, your payment processor checks with the issuing bank to determine if the transaction passes a CVV or AVS check, and ensures funds are available, and that the card is valid.

Issuing Bank

The issuing bank issues accounts, debit, and credit cards directly to your clients. After the transaction passes the checks performed by the payment processor, the issuing bank tells the processor if the payment information is accurate and if payment is possible. The issuing bank then issues an authorization to hold the funds or captures the funds and immediately transfers those funds to your acquiring bank.